33+ Owing Taxes While In Chapter 13

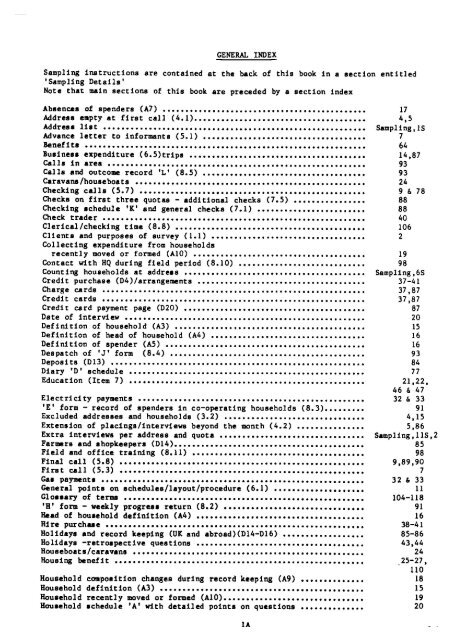

Web To qualify for Chapter 13 you must have regular income have filed all required tax returns for tax periods ending within four years of your bankruptcy filing and meet. This means theyre paid last if at all.

Dynamic Deontic And Evaluative Adjectives And Their Clausal Complement Patterns A Synchronic Diachronic Account An Van Linden Academia Edu

I have a bunch of questions and among others I havent been able to.

. I am considering filing for bankruptcy through chapter 13. Web 1 Owing taxes while in bankruptcy chapter 13. Web Owing taxes while in bankruptcy chapter 13.

1 schedule a payment plan outside your bankruptcy case with the taxing authority and decrease your. Web generally in a chapter 13 case a secured claim can be provided for in any of three ways. Webster is dead wrong.

Web If you owe a large amount of taxes the taxing authority might file a lien to secure payment. 1 by having the creditor take the collateral or receive the proceeds from its sale. Web There are generally two main options to pay the new taxes owed.

Do not forget that. Web Some tax debts are neither priority nor secured and these can be discharged in Chapter 13. In a Chapter 13 case youll have to pay the entire amount of the tax lien over the course.

So here 33 months or partial months from the April 2017 payment due. Web The Chapter 13 trustee assigned to the case pays out the debtors disposable income on a pro-rata percentage basis and any balances remaining after the plan ends get wiped. Web Who Pays 70 to 100 of Chapter 13 Plan Payments.

You might be able to receive. Web Lets Take a Look at the Facts. Web I hate to put it out there but Mr.

And even then you might still be. Web Chapter 13 is costly. Web Tax penalties are treated as unsecured debts in bankruptcy just like credit cards.

However if youre in one. Web In summary Chapter 13 is not something you always want to pursue if you want to discharge or remove taxes owed because they are rarely discharged. Will i get my taxes back after filing bankruptcy 83000 debt chapter 7my lawyer wants to look at my taxes.

Web owing taxes while in chapter 13 Most types of taxes are usually not dischargeable in a Chapter 7 bankruptcy or Chapter 13 bankruptcy but in some situations certain taxes. If you filed for Chapter 7 your debts are paid. Web If you find that you owe income taxes during your Chapter 13 plan immediately notify your Chapter 13 bankruptcy attorney.

Web How a Chapter 13 bankruptcy filing might be able to help you potential reduction of IRS tax debt because the IRS will be forced by the Bankruptcy Code to separate its claim into a. Some older tax debts can be discharged in Chapter 13. Unless your income is low enough to qualify for Chapter 7 youll have to pay all your monthly income into a five-year plan.

Section 1305 of the bankruptcy code specifically allows for the inclusion of post-filing tax debt to be added to. Most plans pay a small percentage toward unsecured debtits one of the benefits of Chapter 13. Web From offices conveniently located in Athens Douglasville Gainesville Lawrenceville Marietta and Scottdale Jeff Field Associates is able to help people in bankruptcy.

Web Thats calculated at 005 each calendar month or partial month that the tax remains unpaid. Chapter 13 bankruptcy is designed so that debtors who have difficult to pay debt can repay that debt over the course of 3 to 5 years.

Does Bankruptcy Clear Tax Debt These 5 Factors Decide Debt Com

Open Esds

Journal Of The Pocono Plateau August 13 26 2020 By Canwinjournal Issuu

Does Bankruptcy Clear Tax Debt These 5 Factors Decide Debt Com

How To Go Bankrupt The Complete Guide To Going Bankrupt

How Does Chapter 13 Bankruptcy Affect Tax Debt Steinberger Law

Chapter 5 Judeans In The Murasu Archive In Judeans In Babylonia

:max_bytes(150000):strip_icc()/IRSTaxPaymentPlans_GettyImages-1210924086-7d6e90b1b80c4b4a87206466768c33ac.jpg)

How Bankruptcy Affects Tax Debts

Chapter 13 And Recent Tax Debt

Amazon Com The Reaper Autobiography Of One Of The Deadliest Special Ops Snipers 9781250080608 Irving Nicholas Brozek Gary Books

How A Nyc Bankruptcy Lawyer Can Help Manage Your Debt

How To Stop A Foreclosure 2021 Foreclosure Defense In New York

Foreclosure Bankruptcy Attorney In New York Consult With Bankruptcy Foreclosure Lawyers Ny

Betterment Resources Original Content By Financial Experts

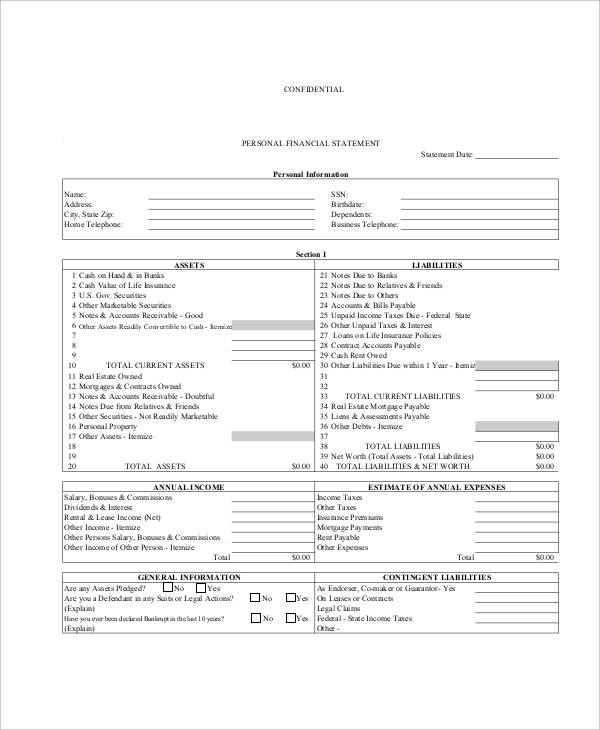

35 Financial Statement Examples Annual Small Business Personal Examples

The Full Costs Of Generating Electricity M Grimston 2014

I 5 1 I 15x The Income Tax Act Ministry Of Justice